Who’d be an economist? Marshalling financial data is a near impossible task at the best of times, but throw in a pandemic, a global economy and energy crisis and the biggest European land war since 1945, and even the most experienced pundits are likely to be scratching their heads.

But, in a sense, data-points don’t matter. Markets, as we know, run on sentiment. Fear. Greed. Hope. Despair. This is as true in the labour market as anywhere else. That’s why WhiteCrow Research decided to find out what candidates themselves are thinking about the next twelve months.

We asked 107 respondents two simple questions:

- Are you worried about the global economy over the coming year?

- Are you worried about your own job over the coming year?

For both questions, we asked candidates to select from one of four answers: 1. No, not all; 2. Yes, slightly; 3. Yes, very; or 4. Yes, extremely.

We discuss the results in detail below, but our chief takeaways are as follows:

- There is little sense of panic, with a majority of candidates either slightly worried about the global economy or not worried at all.

- Candidates are even more bullish about their own prospects, with the huge majority confident they’ll keep their job.

- The region where candidates are most concerned about the economy is EMEA; the region where candidates are least concerned about the economy is the United States.

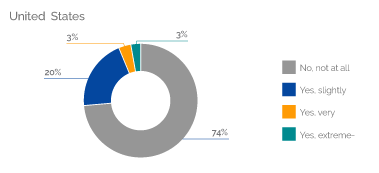

- Just six percent of candidates in the US are either very or extremely worried about losing their job; a whopping 74% are not worried at all.

- The results suggest hiring managers could have some challenging months ahead of them, with candidates likely reluctant to engage in conversation during such uncertain times, especially when they already feel secure in their current role.

Also, check out article on “Be an Agile Shape Shifter” by Matthew Pitt here.

Result & Analysis

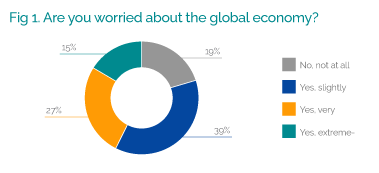

Takeaway 1: There is little sense of panic, with a majority of candidates either slightly worried about the global economy or not worried at all.

Perhaps the most surprising detail of these results is the 19% who have no

concerns about the global economy whatsoever. Remember, our source

pool consists of educated, often highly intelligent professionals who

presumably keep up with the news and have a more than rudimentary

understanding of inflation, energy prices and global affairs. And yet almost

one fifth of these people are entirely relaxed about the coming months.

We’re not saying they’re wrong. We just didn’t imagine there would be quite

so many of them.

Of course, you could flip these results on their head and observe that 81%

of people are worried about the economy to some extent. But that’s why we

filtered the results as we did. Nuance is everything. The fact is, a mere 15%

are ‘extremely’ worried while a hefty 39% are only ‘slightly’ worried. So, yes,

there is a sense of uncertainty, but candidates are certainly not panicking.

Read our detailed article on “Hybrid Working” here.

Result & Analysis

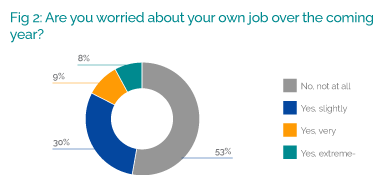

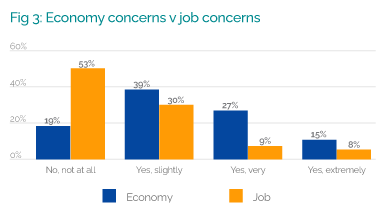

Takeaway 2: Candidates are even more bullish about their own prospects, with a clear majority confident they’ll keep their job.

If candidates are relaxed about the global economy, they’re almost supine concerning their own job prospects. A comfortable majority (53%) are not worried at all about being made redundant. The full import of this finding is illustrated in Figure 3. By comparing answers to both our questions, we see clearly that concern for the economy does not in any way translate to concern for one’s own job security. This is most evident when we look at the percentages of those either ‘very’ or ‘extremely’ concerned. On the economy this combined figure is 42%, not far off half our source pool; but when we look at individual job concerns, that figure plummets to just 17%.

What is driving this dichotomy? Clearly, on some level, candidates are being complacent; it is inconceivable that a downturn in the economy

(which many of them acknowledge is possible) won’t result in increased numbers of redundancies. Perhaps not enough of our source pool have firsthand memories of previous recessions. Or maybe they just imagine bad things only happen to other people. Still, as we always emphasize, hiring managers don’t need to explain candidate sentiment, they just need to know about it and respond accordingly.

Also, check our detailed analysis on “Money Talks” here.

Result & Analysis

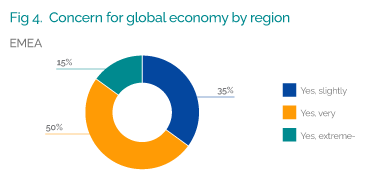

Takeaway 3: The region where candidates are most concerned about the economy is EMEA; the region

where candidates are least concerned about the economy is the United States.

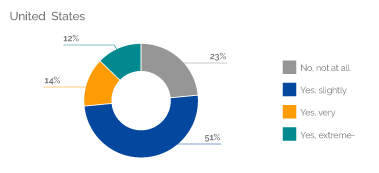

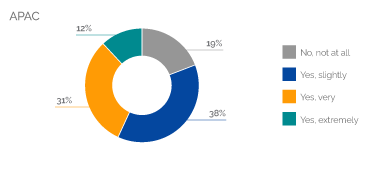

Figure 4 shows there are significant differences in sentiment across various parts of the world. In the US, for example, our initial thesis – i.e. there is no sense of panic – is emphatically supported. Nearly a quarter of respondents are ‘not at all’ concerned about the economy and just 12% are ‘extremely’ worried. Just over half are ‘slightly’ worried which would seem a reasonable view to adopt at any stage of the economic cycle. However, in EMEA, the picture is more gloomy, with 65% either ‘very’ or ‘extremely’ concerned.

Of course, the energy crisis has impacted far more on Europe than the US so perhaps this is reflected in our results. Also, recent US inflation news has been quite positive, another reason Stateside sources could be more bullish. Regardless, this is another example of why hiring managers need to master the science of what WhiteCrow calls ‘talentomics’ – that is, the study of all those factors which dictate

Result & Analysis

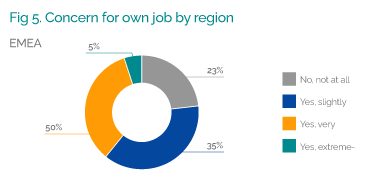

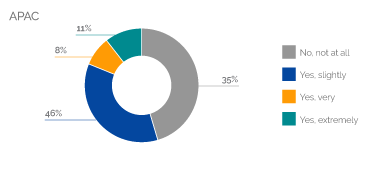

Takeaway 4: Just six percent of candidates in the US are either very or extremely worried about losing their job; a whopping 74% are not worried at all.

We have already seen that most candidates, regardless of geography, are significantly less worried about their own job prospects than they are about the economy as a whole. But Figure 5 shows much of this optimism stems from candidates in the United States. There, 24% are ‘not at all’ worried about the economy, but a remarkable 74% (three in every four people we asked!) are ‘not at all’ worried about their own job. APAC also sees a sizeable leap in this cohort between questions, with 12% unconcerned about the economy but nearly half confident their own job is safe.

EMEA, by contrast, is the most jittery of the three regions. Just 23% have no concern for their job prospects whatsoever but only a minority (39%) described themselves as either ‘very’ or ‘extremely’ concerned.

Our complete “Resources from Industry Experts” is now available here.

Result & Analysis continued

Takeaway 5: The results suggest hiring managers could have some challenging months ahead of them, with candidates likely reluctant to engage in conversation during such uncertain times, especially when they already feel secure in their current role.

So what does this all mean for hiring managers? Our view is they could be in for some difficult times. It comes down to what we know as ‘push’ and ‘pull’ factors. If you’re looking to lure someone away from another company, it helps if they’re slightly worried about their current situation. That’s the push. But if they’re also positive on the broader economy, they’ll likely have no concern that any new job will suddenly be placed ‘at risk’. That’s the pull.

Unfortunately, our findings suggest the very opposite of that situation. Instead of candidates sitting nervously in their seats, hoping for an opportunity in a buoyant market, we have very settled candidates who are reluctant to engage with opportunities in what they see as, at best, an unpredictable market.

Now more than ever, then, TA leaders must show the full range of their skills. They need to be not just recruiters, but also salespeople, brand ambassadors, reward specialists and – yes – economists. They need to understand the data on pay, prices, interest rates, unemployment and much more.

But most importantly, they need to understand candidate sentiment.